Income Splitting Strategies for Incorporated Businesses in Canada

Income splitting is a tax planning strategy that can significantly reduce the overall tax burden for business owners in Canada. For incorporated businesses, particularly small to medium-sized enterprises (SMEs) in Ontario, understanding income splitting is essential to maximizing wealth, protecting family finances, and staying compliant with CRA regulations. Effective tax planning for incorporated businesses can significantly reduce personal and corporate taxes, and income splitting is one of the most powerful tools to achieve this.

Request a Free Consultation

What is Income Splitting?

Income splitting, sometimes referred to as family income splitting, is a tax planning strategy that allows business owners and incorporated professionals to allocate income earned by their business or themselves among family members in order to take advantage of lower marginal tax rates. The primary goal of income splitting is to reduce the overall tax burden on a household in a legal and compliant manner.

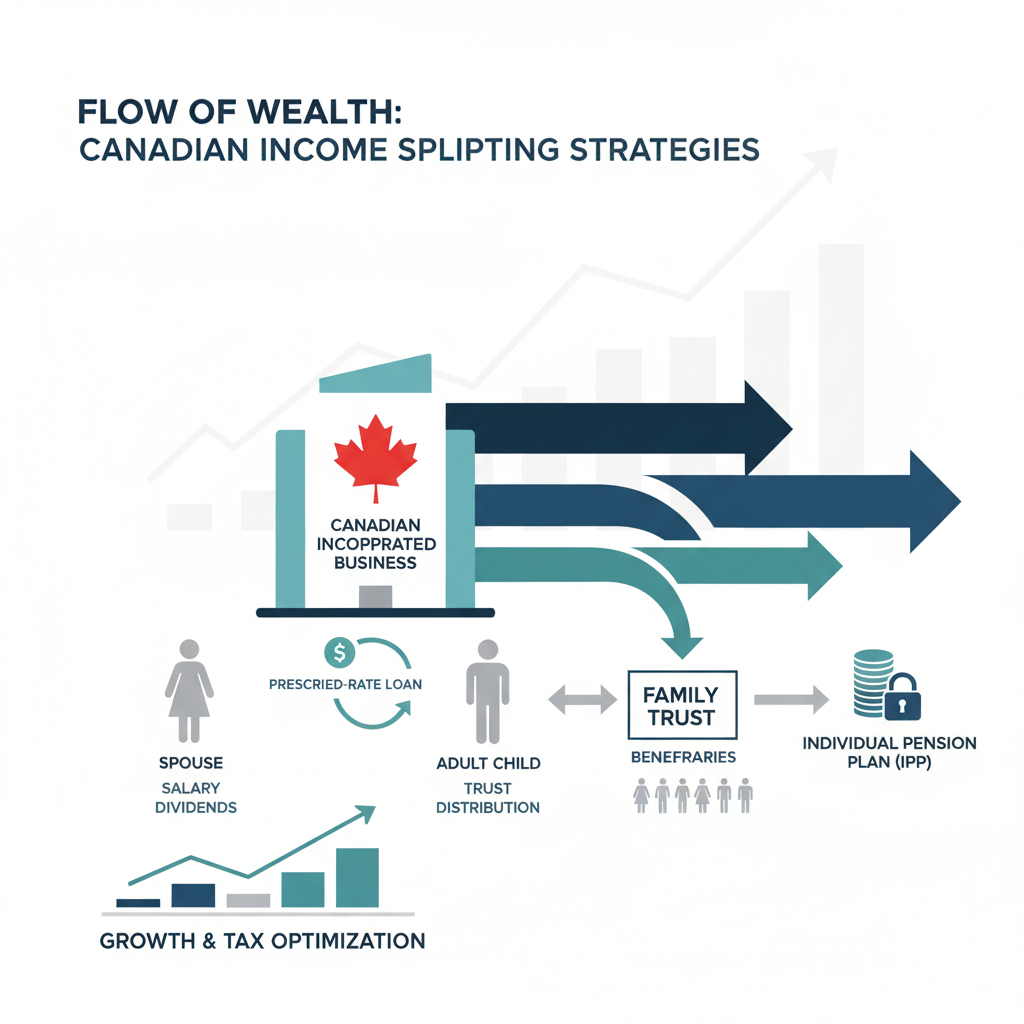

For incorporated businesses, income splitting can take several forms, including paying dividends or salaries to spouses, adult children, or other family members who are shareholders or actively involved in the business. Another common approach involves setting up family trusts, which provide flexibility in distributing income to beneficiaries in the most tax-efficient way. Beyond dividends, salaries, and trusts, there are other legal mechanisms that can be used to shift income from higher-taxed individuals to family members in lower tax brackets, allowing families to optimize their combined tax position. Properly implemented, income splitting not only reduces taxes but can also support retirement planning, facilitate succession and wealth transfer strategies, and help family members build long-term financial security. It is a vital tool for incorporated business owners who want to maximize after-tax income while remaining fully compliant with CRA rules.

Why Income Splitting Matters for Incorporated Businesses

Reducing Overall Tax Burden

By distributing income to family members in lower tax brackets, business owners can minimize the overall household tax rate, keeping more money in the family.

Enhancing Retirement Planning

Income splitting supports retirement planning by enabling family members to contribute to RRSPs or pension plans, allowing tax-deferred growth and building long-term savings.

Succession Planning and Wealth Transfer

Combining income splitting with family trusts or dividend strategies can simplify transferring wealth to the next generation while minimizing tax consequences.

Key Income Splitting Strategies for Incorporated Businesses

Paying Dividends to Family Members

How It Works

Issuing dividends to family members who are shareholders can shift income to those in lower tax brackets. Structuring share classes carefully ensures the most tax-efficient distribution.

Tax on Split Income (TOSI) Considerations

The CRA’s TOSI rules, introduced in 2018, limit income splitting for adult family members not actively involved in the business. Understanding TOSI is critical to avoid penalties.

Example Scenario

A business owner earning $200,000 annually issues dividends to a spouse with little other income. If allowed under TOSI rules, this can save thousands in taxes.

Paying Salaries to Family Members

Legally Permissible Employment

Family members can be employed and paid reasonable salaries, provided they perform actual work for the business.

Advantages

Salaries are deductible for the corporation, reducing corporate taxes. They also allow family members to contribute to RRSPs, building future retirement savings.

Using Family Trusts

What is a Family Trust?

A family trust lets business owners allocate income among multiple beneficiaries, distributing profits in a tax-efficient manner.

Benefits of Family Trusts

- Flexible income allocation

- Supports estate planning and wealth transfer

- Protects assets from creditors

Compliance Considerations

Proper setup and management are essential to comply with CRA rules, so professional guidance is strongly recommended.

Incorporating Lifetime Capital Gains Exemption

Eligible Small Business Shares (ESBS)

Splitting ownership of qualifying small business shares among family members can allow multiple beneficiaries to access the lifetime capital gains exemption, maximizing tax savings during business sale or succession.

Income Splitting Through Retirement Contributions

Pension Plans for Family Members

Contributing to a pension plan or RRSP for family members who are employees reduces corporate taxable income while building retirement savings for the household.

Practical Tips for Implementing Income Splitting

Successfully implementing income splitting strategies requires careful planning, meticulous execution, and ongoing attention to detail. Here are essential guidelines to help you navigate this complex area of tax planning while staying compliant with CRA requirements.

Maintain Accurate Documentation

Comprehensive record-keeping forms the foundation of any successful income splitting strategy. The CRA scrutinizes these arrangements closely, particularly during audits, making proper documentation your first line of defense.

Review Regularly

Tax laws and TOSI rules change over time. Tax legislation evolves continuously, and what worked yesterday may not be compliant today. The Tax on Split Income (TOSI) rules have undergone significant changes in recent years, making regular strategy reviews more critical than ever.

Seek Professional Guidance

Income splitting involves intricate tax rules with severe penalties for non-compliance. The complexity of TOSI legislation, combined with the high stakes involved, makes professional guidance not just advisable but essential.

Common Mistakes to Avoid

- Ignoring TOSI rules, leading to unexpected taxes

- Paying salaries that exceed the actual work performed

- Failing to document distributions properly

- Not reviewing strategies regularly as laws evolve

Frequently Asked Questions About Income Splitting for Incorporated Businesses in Canada

Can I split income with adult children?

Yes, you can, but only if they are actively involved in the business or meet specific exceptions under CRA’s TOSI rules. Income splitting must follow these rules to remain compliant.

What is TOSI, and why does it matter?

TOSI stands for Tax on Split Income. It applies to certain types of income distributed to family members to prevent high-income individuals from shifting income arbitrarily. Understanding TOSI is essential before implementing any income splitting strategy.

Are dividends to a spouse allowed?

Dividends can be issued to a spouse if they legally own shares in the corporation. However, TOSI rules and CRA scrutiny must be considered to avoid additional taxes.

How do family trusts help with income splitting?

Family trusts let you distribute income among beneficiaries strategically, optimizing taxes and supporting long-term estate planning.

Can income splitting reduce corporate taxes?

Yes. Strategies like paying reasonable salaries to family members or issuing dividends can reduce taxable income at the corporate level while benefiting family members in lower tax brackets.

Do I need a professional to set up income splitting?

Absolutely. Income splitting is complex, and mistakes can lead to CRA penalties. A qualified business accountant or CPA ensures your strategies are compliant and tax-efficient.

Key Points on Income Splitting Strategies for Incorporated Businesses in Canada

- Income splitting allows business owners to distribute income among family members to reduce overall tax liability.

- Spouses, adult children, or other family members can be paid reasonable salaries for work performed in the business.

- Dividends can be issued to family shareholders, but care must be taken to comply with tax on split income (TOSI) rules.

- The Canada Revenue Agency (CRA) requires that payments to family members be justified based on actual work or investment in the business.

- Consider using a family trust to allocate dividends or income in a tax-efficient manner across multiple family members.

- Ensure salaries and dividends are reasonable and documented, as CRA can challenge excessive payments.

- Income splitting is most effective when family members are in lower tax brackets, reducing the overall tax burden.

- Proper planning can help maximize RRSP contributions for family members receiving income.

- Corporations can use retained earnings strategically to defer taxes and distribute income in future years.

- Work with a CPA or tax professional to ensure income splitting strategies comply with CRA rules and avoid penalties.

- Track all income distributions carefully to maintain accurate financial and tax records.

- Consider combining salary and dividends to balance personal tax planning with corporate cash flow needs.

- Income splitting strategies should be reviewed annually to account for changes in tax laws or family circumstances.

- Document all decisions and agreements formally, such as through shareholder agreements or board resolutions.

- Use income splitting to plan for retirement, transferring income to family members in a tax-efficient manner.

How Gondaliya CPA Can Help

Gondaliya CPA specializes in helping incorporated business owners in Ontario implement effective income splitting strategies while staying fully compliant with Canadian tax laws. Our goal is to provide personalized guidance that minimizes tax liabilities, maximizes wealth distribution among family members, and ensures your business remains fully compliant with CRA regulations.

Our services include:

- Corporate Tax Planning

We help business owners optimize both personal and corporate taxes for maximum efficiency. By analyzing your corporate structure, income streams, and family financial situation, we develop strategies that legally minimize tax obligations while supporting your long-term financial goals. - Income Splitting Advice

Our team provides expert guidance on structuring salaries, dividends, and trust distributions among family members. We ensure that all income allocation strategies comply with tax on split income (TOSI) rules and CRA requirements, helping you reduce overall tax burden while maintaining fairness and transparency. - CRA Compliance and Reporting

Navigating CRA rules for income splitting can be complex. We ensure that all strategies and transactions are fully documented, reported accurately, and compliant with current regulations. This reduces the risk of audits, penalties, or adjustments from the CRA.

By partnering with Gondaliya CPA, incorporated business owners gain peace of mind knowing their tax planning is optimized, compliant, and aligned with long-term financial goals. Our team provides ongoing support, monitoring changes in tax legislation, and adjusting strategies as necessary to keep your business and family finances on track.

We focus on delivering practical, actionable solutions that save money, streamline processes, and protect both your personal and corporate wealth.

Sharad Gondaliya is a CPA Canada & CPA USA with 14 Years+ experience of Accounting, Tax, Payroll of Corporate Small Businesses as Tax Accountant. He is fully certified CPA Ontario and CPA USA and is well known among corporate small businesses for tax planning, efficient tax solutions, and affordable CPA services. Sharad is the Principal (Director) of Gondaliya CPA – Affordable CPA Firm in Canada. Licenses: CPA Ontario: 61040184 | CPA USA (MT): PAC-CPAP-LIC-033176 | CPA USA (WA): 57629 | CPA Firm License: 61330051 View Full Author Bio