Toronto Corporate Tax Planning vs Tax Preparation: What Business Owners Should Know

Corporate tax planning plays a key role in helping Toronto businesses manage their tax liabilities effectively, and Gondaliya CPA offers expert services in tax preparation and corporate tax filing tailored to local regulations. Their team of corporate tax accountants provides clear strategies for Toronto and Mississauga businesses to stay compliant with CRA rules while maximizing tax savings through detailed tax consulting and planning.

Request a Free Consultation

Corporate Tax Planning Toronto: Expert Services by Gondaliya CPA for Business Tax Preparation and Filing

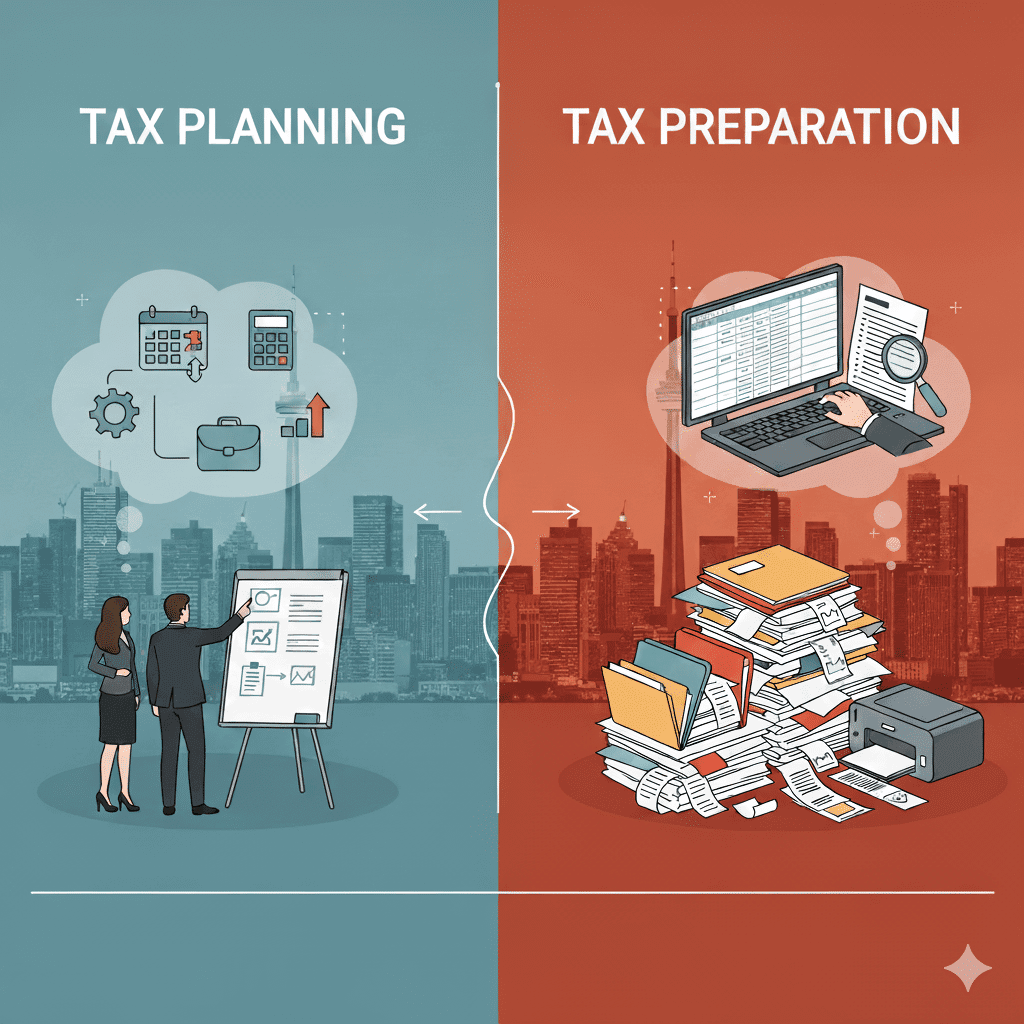

Corporate Tax Planning vs. Tax Preparation: What’s the Difference?

It’s key for business owners in Toronto and Mississauga to know how corporate tax planning and tax preparation differ.

Tax Preparation Defined: Focus on Compliance and Filing

Tax preparation means following Ontario’s rules and filing your tax returns right. This involves collecting your financial papers, figuring out what you owe, and sending forms to the Canada Revenue Agency (CRA). For example, a small business accountant in Toronto helps clients file accurate returns so they don’t get fined for late or wrong submissions.

Corporate Tax Planning Defined: Proactive Strategies for Optimization

Corporate tax planning looks ahead. It uses smart ways to lower taxes over time. Businesses might manage investments or use custom plans that fit their needs. They could try income splitting or tap into special investment credits that apply to their industry.

Examples of Each: Illustrating the Contrasts

Here’s how they differ:

- Tax preparation means just doing your annual return based on past data.

- Corporate tax planning means chatting with your business tax accountant about possible deductions before year-end.

Why Corporate Tax Planning Matters for Toronto and Mississauga Businesses

Good corporate tax planning is really needed because of the unique issues companies face in the Greater Toronto Area (GTA).

The Unique Tax Environment in the GTA

The GTA has its own rules that affect taxes. These can change often. Keeping up with these rules helps businesses stay legal and save money by finding tax breaks.

Local Business Challenges: The Need for Strategic Planning

Small businesses see ups and downs in their money flow. They need smart plans to deal with this. Local experts can guide them through benefits like R&D credits or capital cost allowances made for startups around here.

Statistical Data: Average Effective Tax Rate for Ontario Small Businesses (12.2%)

Data shows small Ontario businesses pay about 12.2% in taxes on average. By planning taxes well early, companies can cut down what they owe while following both federal and provincial laws.

Who Benefits Most From Corporate Tax Planning?

Knowing who gains from good corporate tax planning shows why it matters:

- Startups aiming to grow need plans that keep costs low at first and help find grants or credits during key stages.

- Established small and medium businesses looking to expand need plans that cover short-term needs and long-term goals.

- All these are possible when experts familiar with local Ontario tax rules provide advice.

Navigating Compliance and Avoiding Pitfalls

Corporate tax compliance matters a lot for businesses in Toronto and Mississauga. It helps avoid penalties and keeps your finances on track. Knowing the latest CRA corporate tax guidelines makes things easier. Ontario’s rules and federal regulations add extra layers to follow. Good GTA corporate tax planning means not just saving money but also meeting all CRA compliance requirements in Ontario.

Ontario-Specific CRA Compliance Requirements: 2025-2026 Update

For 2025-2026, some important provincial corporate tax changes will affect businesses in the GTA, including Toronto and Mississauga.

Here’s what’s new:

- Provincial Corporate Tax Rate Changes: The rate goes from 11.5% to about 12%, starting January 1, 2025. This affects income above certain limits.

- Income Tax Act (ITA) Sections: You need to follow parts of the ITA that cover corporate taxation at both federal and Ontario levels.

- CRA Guidelines: The CRA wants stricter proof for deductions and credits claimed by corporations in Ontario. Section 230(1) of the ITA requires detailed records for expenses.

These changes mean you must check your filings carefully. Missing updates can lead to audits or reassessments that cost time and money.

Common Corporate Tax Pitfalls and How to Avoid Them

Many small businesses in Toronto slip up with corporate taxes. These mistakes can cost a lot if not fixed.

Ignoring Tax Installment Deadlines

Ontario wants corporations paying more than $3,000 in taxes yearly to make quarterly payments. These usually happen in March, June, September, and December. Paying late means daily interest charges pile up until you pay.

Penalty Example: If you miss a $10,000 payment, interest can add over $200 each month.

Late Filing Penalties

You have six months after your fiscal year ends to file T2 returns. If you file late, expect penalties starting at 5% of unpaid taxes plus 1% for every extra month, up to a year.

Example: A Toronto company owing $50,000 that files two months late faces penalties of about $2,500 right away. More delays mean even bigger fees.

Expense Classification Errors

Mixing personal costs with business expenses is risky. The CRA might reject those deductions during audits. This can hike your taxable income and trigger fines under Section 163(2) of the ITA for false info.

Avoid this by keeping clear records. Keep personal and business expenses separate with matching receipts.

| Common Pitfall | Consequence | Prevention Tip |

|---|---|---|

| Ignoring installment deadlines | Interest charges & cash flow issues | Set reminders; use accounting tools |

| Late filing | Monetary penalties & audit risk | File early; get expert help |

| Expense misclassification | Disallowed deductions & fines | Organize records; consult a CPA |

Good GTA corporate tax planning means tracking deadlines carefully. Make sure expense categories follow CRA rules exactly. Working with experienced pros helps you avoid mistakes while still saving money based on local laws.

Understanding these basics gives businesses in Toronto and Mississauga peace of mind. They meet legal requirements well and make smarter tax decisions as provincial rules change.

Effective Tax Planning Strategies for Toronto Businesses

Corporate tax planning in Toronto helps businesses pay less tax and get the most deductions. It’s more than just filing your taxes. It means looking at your finances all year to use credits and manage cash well. For Toronto and Mississauga companies, it means following local CRA rules and Ontario’s tax laws.

Good tax management means finding every deduction you can claim. It also means using investment credits smartly and choosing when to report income. Doing this helps lower taxes and keeps you on the right side of the CRA. This way, your business can keep cash flowing and grow steadily in the tough GTA market.

Strategic Corporate Tax Planning Approaches for Toronto Businesses

Toronto businesses face special rules under Ontario corporate income tax. To pay less tax and follow the law, try these ideas:

- Investment Tax Credits (ITCs): Ontario gives credits for things like buying machines or energy upgrades.

- R&D Tax Credits & SR&ED Incentives: The SR&ED program refunds money for research work—great for tech firms in Toronto.

- Tax Deferral Tricks: You can delay reporting income or selling assets so you pay tax later when rates might be lower.

- Ontario Corporate Income Tax Compliance: Keep up with changes, like new small business rates starting in 2025, to avoid fines.

You need to know CRA rules well to use these credits right. Experts help you get all credits without breaking any rules.

Income Splitting Strategies: Salaries vs Dividends

Income splitting spreads money among family members who pay less tax. In Toronto’s high-tax setting, mixing salaries and dividends can save a lot.

- Pay salaries that are fair so you earn CPP benefits but watch out for payroll taxes.

- Dividends are taxed differently, don’t count toward RRSPs or CPP but offer flexibility.

For example, a startup owner may take a small salary and give dividends to adult kids who own shares. This lowers the total family tax bill legally under CRA rules.

You must keep good records here. If you mix payments up, CRA might audit or charge penalties for wrong shareholder benefits.

Maximize Capital Cost Allowance (CCA) – Tax Depreciation

Capital Cost Allowance lets companies write off asset costs like equipment over time instead of all at once. Claiming CCA smartly cuts taxable income in GTA businesses.

Buy Capital Assets Just Before Business Year End

Buying assets near year-end means more CCA claims this year. That lowers your tax bill fast and helps cash flow right away.

Sell Business Capital Assets After Business Year End

Wait until after year-end to sell assets. This pushes some taxable income into next year, smoothing profits over time when combined with other plans and good corporate bookkeeping services.

Use professional accounting to track this closely. It stops unexpected gains that cause higher taxes under Canadian law (like ITA Section 13).

Other Important Corporate Tax Planning Strategies

Here are some other ways GTA businesses can manage their taxes:

- Private Pension Plans: Setting one up can save on taxes now and build retirement savings.

- Shareholder Loan Management: Pay back shareholder loans within two years or face extra personal tax charges from CRA.

- Reasonable Salary Choices: Mix dividends with salary or bonuses carefully so pay matches what others in your industry get. This avoids being flagged as “unreasonable” by auditors.

These strategies give Toronto small businesses—from startups to growing ones—clear steps based on local rules and changes coming in 2025–26. Gondaliya CPA helps clients plan well and act right so they pay less tax but stay legal.

| DIY | Bookkeeper | CPA Corporate Tax Planning |

|---|---|---|

| Costs little ($0-$1k) | Medium cost ($500-$3k) | More expensive ($2k-$8k) |

| Less knowledge; miss credits | Basic record keeping; some deadline help | Expert advice; finds max deductions & keeps you compliant |

| High audit risk from mistakes | Fewer errors but limited strategy | Full plans including R&D/SR&ED credits |

| No personalized timing or splitting help | Some help with installments/taxes owed | Regular reviews & custom plans |

Start using these ideas each year from September to December. Keep up quarterly filings too. Doing this puts your company ahead of costly errors many GTA entrepreneurs make because they don’t know Ontario’s complex rules well.

Meta Description Example:

Find smart corporate tax planning tips made for Toronto businesses by Gondaliya CPA. Learn how income splitting, CCA claims, R&D incentives, and local compliance cut taxes in 2025–26.

Contact us today for advice that fits your business size and type!

Gondaliya CPA: Solving Challenges Through Corporate Tax Planning

Many businesses in Toronto and Mississauga mix up corporate tax planning with just filing taxes. But they’re quite different. Corporate tax planning in Toronto means planning ahead to lower taxes before the year ends. Tax preparation comes after the year closes and focuses on filling out forms correctly. Our seasoned accounting professionals craft tailored tax strategies that fit your business goals well. We keep talking with you and give expert guidance to handle tricky CRA rules and boost your finances.

As a trusted business tax accountant in Toronto, Gondaliya CPA offers full corporate tax services. We handle corporate tax filing Toronto companies trust and do precise corporate tax return preparation. We make sure everything is clear and follows Ontario’s changing rules.

Corporate Tax Planning Services Offered

We cover all parts of corporate income tax Toronto businesses deal with. Our GTA corporate tax planning works for startups and growing firms needing Ontario corporate tax compliance.

Here’s what we offer:

- Smart income splitting to lower taxable income

- Using investment credits like SR&ED for R&D incentives

- Deferring taxes by optimizing capital cost allowance

- Spotting deductible expenses based on CRA rules

We create each plan based on your industry, size, and growth path. This way, you get the most from provincial laws.

Tax Preparation and Filing Expertise

Filing taxes right avoids penalties or audits. Our team knows how to prepare T2 corporate tax returns and send them on time per CRA deadlines for Ontario companies.

We do full-service tax preparation Toronto firms trust—checking all papers so you file accurate returns without mistakes. That cuts audit risks and keeps you legal on both federal and provincial levels.

Accounting Services for Complete Financial Management

We don’t just do taxes; our corporate bookkeeping services keep your records neat year-round. Good books make financial statement prep easier when you need loans or report to investors.

Mixing accounting with smart tax advice gives a full picture that helps your business grow while lowering what you owe.

Gondaliya CPA’s Tax Planning Solutions for GTA Businesses

Ontario CRA guidelines change often, so staying current matters for GTA businesses. Our team watches federal policies and local rules closely—including 2025–2026 changes—to keep you in line with no shocks.

We warn clients early about rule shifts affecting deductions, payments, or credits so they can tweak plans well before deadlines come.

Ontario Tax Updates: Navigating 2025–2026 Provincial Changes

The combined federal-provincial rate for Ontario small businesses is about 12.2%. But some new laws starting 2025 will tweak eligibility for perks like scientific research credits (SR&ED) that many Toronto tech firms use.

Knowing these updates helps avoid costly mistakes like missing claims or wrong expense reports that could lead to big fines from the Canada Revenue Agency (CRA).

CRA Regulatory Updates for Continued Compliance

- You must keep detailed records to back deductions claimed.

- Installment payments happen quarterly; paying late costs interest.

- Audit chances rise if filings don’t match bank deposits or related party deals.

Gondaliya CPA helps clients meet these demands and offers audit representation if needed—cutting stress by explaining things clearly with good records.

Real‑World Examples of Tax Planning Success

Example 1: Toronto Tech Startup Reducing Tax Rate Through Income Splitting

A tech startup making $2 million yearly in downtown Toronto dropped its effective rate from about 26.5% to near 18%. They used careful dividend vs salary plans that followed shareholder loan rules under TOSI laws plus set reasonable salaries designed around cross-border tax issues common to GTA tech firms.

This smart portfolio management lifted profits by maximizing deductions while legally lowering what they owe—a result of ongoing talks focused on fresh ideas made just for fast-growing startups in local markets.

Example 2: Mississauga Manufacturing Business Saving with Capital Cost Allowance

A manufacturing company in Mississauga saved more than $35,000 a year by optimizing capital cost allowance claims plus taking investment credits including SR&ED perks used by many GTA industries.

Fixing expense classification errors often seen in mid-sized makers—and matching quarterly GST/HST filings exactly—helped improve cash flow while carrying forward losses into future years allowed under Canadian corporation laws.

| DIY | Bookkeeper | CPA Corporate Tax Planning |

|---|---|---|

| Low upfront costs | Moderate fees ($500-$1K) | Higher fees ($2K-$8K) |

| High risk; limited skills | Basic accuracy; no strategy | Custom strategies |

| No protection vs penalties | Limited advice beyond data entry | Expert guidance reducing risks |

| Time-consuming & error-prone | Saves time but lacks depth | Efficient process saving money long-term |

| Month | Task |

|---|---|

| September | Review last year’s results; spot new chances |

| October | Update forecasts; start tax deferral moves |

| November | Finalize deductions; get paperwork ready |

| December | Check income splitting setups |

This checklist helps keep things moving toward good year-end tax positions required by many GTA corporations under CRA watch each fiscal cycle.

For custom plans combining local know-how with service made for corporate income tax Toronto needs — call Gondaliya CPA where clear advice meets confidence all along your way to smarter tax choices.

| Understanding the Cost of Corporate Tax Planning in the GTA |

|---|

Corporate tax accountant fees in Toronto and the GTA can differ a lot. It mostly depends on what your business needs. The cost for corporate tax services changes with how big or complex your company is. Many small businesses think tax prep is the same as corporate tax planning, but it’s not. That mistake can make them miss out on saving money.

Accounting firms in the GTA set their prices based on what each client needs. DIY methods or using just a bookkeeper may seem cheaper at first. But they often don’t offer smart tax strategies. A business tax accountant in Toronto knows CRA rules well. They also know Ontario laws and help get you all possible deductions and credits.

| Understanding the Cost of Corporate Tax Planning in the GTA |

|---|

Most small to medium businesses around Toronto and Mississauga pay between $2,000 and $8,000 each year for corporate tax planning. This fee covers things like checking income streams, sorting expenses right, claiming investment credits like SR&ED, and setting up plans like income splitting.

The price changes based on how complicated your finances are. Also, whether you want advice all year or just a one-time check matters. Spending this amount usually saves you more money by cutting your taxable income better than basic filing does.

| Average Cost Range: $2,000 – $8,000 |

|---|

Factors Impacting Pricing: Complexity and Scope of Services

Many things affect how much tax consulting services cost:

- Size of your business and revenue

- Industry credits (like for tech startups or manufacturers)

- Number of companies you own

- How much planning you want (full year or just end of year)

- How often you meet with your accountant

Setting up an initial consultation helps figure out what you need and gives clear pricing.

Comparison Table: DIY vs. Bookkeeper vs. Gondaliya CPA Corporate Tax Planning

| Feature | DIY | Bookkeeper | Gondaliya CPA (CPA Firm) |

|---|---|---|---|

| Cost | Very low | Moderate | $2,000 – $8,000 |

| Expertise | Limited | Basic bookkeeping | Certified experts; GTA focused |

| Tax Strategy | None | Limited | Full planning & optimization |

| Compliance Assurance | Risky | Medium risk | Fully compliant with Ontario laws |

| Potential Savings | Low | Medium | High – up to 30% reduction |

| Penalty Risk | Low awareness | Moderate | Minimal due to oversight |

This table shows why a pro firm in Toronto is often worth it. They help avoid risks from audits or fines while saving more money.

Year-End Tax Planning Timeline: A Step-by-Step Guide

Good year-end tax planning starts early — usually September — and goes till December before filing returns. Sticking to a timeline stops missed deadlines and helps grab every credit available before the year ends.

Timeline: September to December Planning Process

- September

- Check financials against budget

- Spot chances for income splitting

- Look at R&D credits like SR&ED

- October

- Finish buying capital assets for depreciation

- Set installment payments based on estimated taxes

- November

- Review how expenses are classified

- Gather papers to back up claims

- December

- Make last donations if any

- Finalize adjustments before closing books

Following these steps avoids costly mistakes common among GTA small businesses new to local rules.

Quarterly Tax Filing Deadlines: Staying on Schedule

Businesses in Ontario must file quarterly taxes as per CRA rules:

- Q1 Deadline: March 31

- Q2 Deadline: June 30

- Q3 Deadline: September 30

- Q4 / Year-End Filing: December 31 (or next calendar day)

Filing late can mean penalties from hundreds to thousands of dollars depending on delay time. Managing deadlines alone is tough without expert help.

Keeping organized monthly records makes filing easier and meets CRA compliance rules for Ontario’s updated laws through 2025–2026.

Corporate Tax Planning Timeline Checklist for GTA Businesses

| Month | Key Tasks |

|---|---|

| January – February | Review last year’s return; plan ways to improve |

| March – April | Submit first quarter installment; update forecasts |

| May – August | Track expenses; prep R&D claim documents |

| September | Start year-end plans; check credit eligibility |

| October | Decide on capital asset purchases; finalize estimated taxes |

| November | Review expense categories; confirm installment payments |

| December | Close books carefully; make last donations/deductions |

Using this checklist helps meet both federal and Ontario-specific rules coming into effect in 2025–2026.

Knowing costs and timelines made for Toronto and Mississauga businesses lets you pick experts who do more than just file paperwork properly under provincial changes ahead.

Finding an Income Tax Consultant in Toronto and the GTA

Picking the right income tax consultant matters for small businesses in Toronto and nearby areas. Corporate tax accountant fees in Toronto usually range from $2,000 to $8,000. The cost depends on how complex your needs are. Business tax accountants in Toronto know Ontario’s CRA rules well. They can help you save money and avoid penalties.

Small business accountants in Toronto give services like tax planning, filing, and support. When you work with a professional accounting firm in the GTA, you get help from experienced tax professionals. They offer expert guidance all year long. Plus, you’ll get clear pricing for tax consultant services so there won’t be surprises.

Hiring a skilled income tax consultant means your business follows all federal and provincial rules. You can also make the most of credits like SR&ED or investment incentives for Ontario’s 2025-2026 changes.

Frequently Asked Questions About Corporate Tax Planning

How Much Do Corporate Tax Accountants Charge in Toronto?

Corporate tax accountant fees in Toronto depend on your business size and what you need. On average:

- Basic corporate tax preparation costs between $1,500 and $3,000

- Full corporate tax planning runs from $3,000 to $8,000

The price changes based on how complex your revenue is and what advice you need. It’s best to schedule a consultation early to get a cost estimate that fits your business in the GTA.

When Should You Hire a CPA?

You should hire a CPA when you need more than just basic bookkeeping or simple tax returns. Compared to general tax preparers or doing taxes yourself:

- CPAs do proactive corporate tax planning

- They understand tricky CRA rules for Ontario companies

- Professional accounting firms offer advice all year, not just during tax time

Startups or growing businesses can save money by working with an experienced CPA early on.

What Is the Difference Between Tax Planning and Tax Preparation?

Tax preparation means gathering info to file taxes correctly by deadlines. It focuses on following rules but doesn’t cut future taxes.

Corporate tax planning looks at your finances ahead of time. It tries to lower taxes over time using methods like income splitting or deferrals that work well for GTA businesses.

So:

- Tax Preparation: A reactive task to file taxes right

- Tax Planning: A strategy to pay less tax over time

Knowing this difference helps small businesses around Toronto avoid missing chances to save.

How Can Businesses Stay CRA Compliant in Ontario?

To stay compliant, follow both federal CRA rules and Ontario’s provincial laws under the Income Tax Act (ITA). Important steps include:

- File accurate returns before installment deadlines

- Classify expenses right under ITA rules for 2025–2026

- Keep good records to back up any deductions

Recent CRA updates focus more on audits of R&D claims (SR&ED), which affects many tech startups around the GTA. Working with experts helps you follow these rules without risk.

What Are Penalties for Late Corporate Tax Filing?

| Offense | Penalty Example |

|---|---|

| Missed first deadline | At least 5% of unpaid taxes |

| Delay over 12 months | Fines can go up to 20% |

| Ignoring installment payments | Interest plus extra late fees |

For example, missing quarterly payments could mean thousands in charges plus interest. Experts who know local deadlines help avoid these costs.

This info shows how Gondaliya CPA helps small businesses near Toronto and Mississauga with clear pricing and expert guidance for Ontario’s corporate taxes. Whether you want to understand fees better or learn about different services—our team is ready as partners focused on lowering your taxes while staying fully compliant with all laws.

Frequently Asked Questions About Corporate Tax Planning in Toronto

What are the main differences between tax preparation and tax planning?

Tax preparation means filing returns correctly and on time. Tax planning uses strategies to reduce taxes before filing. Planning focuses on future savings, preparation on compliance.

How does corporate tax deferral work in Ontario?

Deferral lets businesses delay taxable income recognition to a later year. This can lower taxes if future rates are lower or cash flow needs are better managed.

What are common pitfalls in corporate tax compliance Ontario businesses face?

Late filings, missed installment payments, and expense misclassification cause penalties. Keeping accurate records and meeting deadlines prevents these issues.

How can R&D tax credits benefit GTA businesses?

R&D credits reduce payable taxes for eligible research expenses. Many tech companies use SR&ED incentives to boost cash flow and fund innovation.

Why is income splitting important for small business tax planning Toronto?

Income splitting spreads income among family members in lower brackets, lowering total family taxes legally under CRA rules.

What should I know about quarterly tax filings in Ontario?

Corporations paying over $3,000 must submit installments quarterly: March, June, September, December. Missing deadlines triggers interest and penalties.

How do the 2025-2026 corporate tax rate changes affect Toronto companies?

Ontario’s rate rises to about 12% on income above certain limits. Businesses should adjust plans to optimize deductions under new rates.

What services does Gondaliya CPA provide for corporate tax return preparation?

We handle T2 returns accurately and timely. Our expert team ensures compliance with CRA guidelines and maximizes eligible deductions.

Essential Corporate Tax Strategies for Toronto Businesses

- Maximize business tax deductions by reviewing eligible expenses regularly.

- Use customized corporate tax strategy to fit your industry and size.

- Employ strategic portfolio management for long-term financial viability.

- Stay updated on regulatory compliance with ongoing communication from your advisors.

- Optimize capital investment tax planning using CCA claims effectively.

- Incorporate private pension plans to enhance retirement savings with tax advantages.

- Manage shareholder loans carefully to avoid additional personal tax charges.

- Balance salaries and dividends using income splitting techniques within CRA rules.

- Prepare for corporate reorganizations by assessing their potential tax impacts early.

- Utilize SR&ED incentives GTA-wide for tech-related research projects.

- Meet all quarterly tax filing deadlines to avoid costly penalties Ontario-wide.

- Benefit from CRA audit representation provided by expert advisors when needed.

- Keep accurate bookkeeping to enhance accuracy in your corporate filings and financial statements.

- Follow the year-end tax planning process diligently with a clear timeline checklist.

- Use strategic tax advice to boost business profitability while minimizing corporate tax payable.

Contact Gondaliya CPA for expert guidance in navigating Toronto’s local tax environment confidently and efficiently.

Sharad Gondaliya is a CPA Canada & CPA USA with 14 Years+ experience of Accounting, Tax, Payroll of Corporate Small Businesses as Tax Accountant. He is fully certified CPA Ontario and CPA USA and is well known among corporate small businesses for tax planning, efficient tax solutions, and affordable CPA services. Sharad is the Principal (Director) of Gondaliya CPA – Affordable CPA Firm in Canada. Licenses: CPA Ontario: 61040184 | CPA USA (MT): PAC-CPAP-LIC-033176 | CPA USA (WA): 57629 | CPA Firm License: 61330051 View Full Author Bio