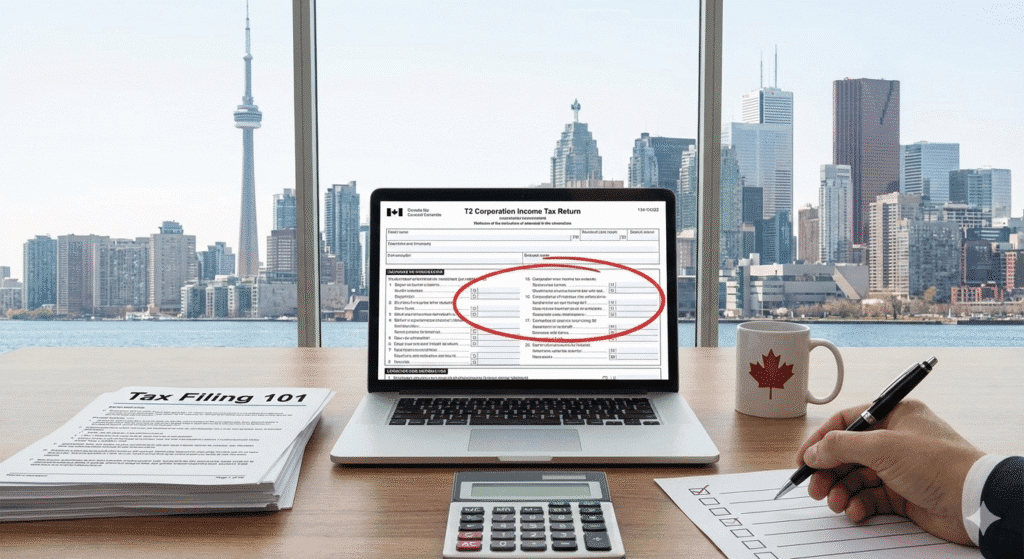

Toronto Corporation Tax Filing 101: Avoiding Common T2 Return Mistakes

Corporation tax filing mistakes are common but avoidable with the right guidance from corporate tax experts, who specialize in accurate T2 return preparation and compliance with CRA rules in 2025. By addressing issues like misclassified expenses, missing schedules, and incomplete deductions early on, Toronto corporations can reduce the risk of reassessments, penalties, and audits with support from experienced tax accountants.

Request a Free Consultation

Toronto Corporation Tax Filing Mistakes to Avoid in 2025: Expert T2 Return Tips from Gondaliya CPA Corporate Tax Experts

Why Accurate Corporate Tax Filing Matters for Toronto Businesses

Filing your corporate taxes right matters a lot for Toronto businesses. It helps you follow rules set by the Canada Revenue Agency (CRA). When you file correctly, you avoid fines and audits that can cost time and money. Good record keeping protects your company’s money. It also makes the whole filing process less stressful. Messing up your filings can cause CRA to review them again, which might slow down your business.

Avoiding CRA Scrutiny, Penalties, and Audits

T2 corporate tax filing errors can bring CRA’s attention fast. Simple mistakes like wrong income numbers or missing forms lead to penalties or audits. Here’s how you can lower those risks:

- Check Every Paper: Make sure all forms and numbers are correct before sending them in.

- Keep Good Records: Track your finances all year long so nothing is lost.

- Get Expert Help: A professional CPA knows the rules and spots mistakes early.

Doing these things lowers the chance that CRA will come knocking with reassessments or penalties.

Maximizing Tax Deductions and Credits

You want to pay less tax by using all the deductions available. Many businesses miss out on claiming expenses that they could. Try this simple plan:

- Write down all business expenses carefully.

- Look up tax credits that apply to your company’s work.

- Ask a CPA for help finding savings you might not see.

When you claim the right expenses and credits, you reduce what you owe and keep more cash flowing in.

Maintaining Compliance and Reputation

Filing on time keeps you in good standing with CRA and protects your company’s name in Toronto. Late or wrong filings cause interest charges and late fees that pile up quickly. To stay on track:

- Teach your team about tax compliance regularly.

- Set reminders well before deadlines so you have time to gather papers.

Doing these steps helps protect both your money and reputation from harm.

| Common Toronto T2 Filing Mistakes | How to Avoid Them |

|---|---|

| Incorrect Income Reporting | Double-check numbers against financial records |

| Missing Schedules | Use checklists before submitting your forms |

| Misclassified Expenses | Keep expense categories clear during the year |

Follow these tips to make T2 returns smoother and avoid mistakes that draw unwanted CRA attention.

Common Toronto Corporation Tax Filing Mistakes to Watch Out For

Many Toronto businesses mess up when filing their T2 corporate tax returns. They often report income wrong, miss required schedules, mix up expenses, or leave deductions incomplete. These slip-ups can bring CRA reassessments and penalties that hurt your business finances.

Incorrect income reporting means you don’t declare all your revenue. Missing schedules or forms slow things down and can trigger audits. Misclassified expenses get denied as deductions, which makes your taxable income bigger than it should be. Incomplete deductions cost you real tax savings.

Avoiding these common T2 filing mistakes helps your business file taxes in Toronto smoothly and keeps CRA penalties at bay.

Missing Deadlines for Filing or Payments

You gotta meet tax filing deadlines in Toronto to dodge interest charges on unpaid taxes and CRA penalties. For most corporations, the T2 filing deadline is six months after the fiscal year ends. But payments are due earlier — usually within two months after year-end, or three months for some small CCPCs.

Late filings or payments open the door to penalty avoidance tactics. But relying on those can cause more costs later. Staying on time with filings and payments keeps your business in good standing with CRA and avoids extra fees.

Here’s a quick checklist for deadlines:

- File T2 returns within 6 months of fiscal year-end

- Pay taxes within 2 months (3 months for some small CCPCs)

- Avoid late penalties and interest charges

Consequences of Late Filing: Penalties and Interest Charges

If you file late, CRA hits you with penalties right away. They charge 5% of what you owe plus 1% every month up to 12 months max. Interest piles up daily on any unpaid taxes until you pay it all.

These costly penalties can surprise your cash flow. Sending accurate returns early stops these extra charges from hurting your bottom line.

Importance of Timely Remittance of Tax Installments

Toronto companies often pay quarterly tax installments based on estimated taxes owed during the year. Paying on time avoids interest charges that kick in if you miss or underpay installments.

Stick to a schedule for tax installment payments so your business stays clear with CRA rules. It also helps spread out tax bills instead of facing one big payment at year-end.

Inaccurate Financial Records and Bookkeeping

Good bookkeeping is key for correct T2 filings. Messy books cause missed deductions or wrong financial reports—both red flags for CRA reviews.

Use bookkeeping best practices like cloud bookkeeping in Toronto. These tools automate data entry and cut down errors. Organized records catch every deductible expense, which can save money and lower audit risk.

Here’s why messy books hurt:

| Common Bookkeeping Issues | How They Affect Your Tax Return |

|---|---|

| Missing receipts | Lose chances for deductions |

| Unreconciled accounts | Report income wrong |

| Poor expense tracking | Show higher profits, pay more tax |

Keeping neat business financial records builds trust with auditors and investors.

Incomplete or Disorganized Documentation

Review all documents carefully before filing to avoid missed details that delay returns or trigger audits. Keep detailed paperwork like invoices, contracts, bank statements, and payroll records organized well.

Tips to manage documents:

- Store digital copies safely using cloud storage

- Update files regularly through the year

- Check docs match reported numbers before submitting

This matches good tax record keeping practices so claims like business expense claims stand strong under review.

Omitting Income Sources (Grants, Investments, Foreign Income)

One common error is leaving out income types such as government grants, investment earnings, or foreign income on T2 returns.

Not reporting these incomes means missing credits and risks CRA reassessments.

Make sure to:

- Report all grant money received

- Include all dividends and capital gains (investment income reporting)

- Declare foreign-earned revenue per Canadian tax rules (foreign income reporting)

Listing everything cuts risk tied to unreported income while keeping compliance solid.

Consequences of Unreported Income

Skipping income leads to:

- Extra assessments with back taxes plus interest

- Higher chance of audits looking for errors

- Missed credits linked to that income

Reducing this risk shields companies from surprise bills later.

Strategies for Comprehensive Income Reporting

Try these steps:

- Regularly check accounting records against deposits

- Get help from CPAs who know multi-source incomes well

- Use software made for tracking different revenue streams

These help ensure reports are accurate and meet CRA standards fully.

For Toronto businesses wanting smooth T2 submissions from 2025 onward: keep books tidy and file on time to dodge costly mistakes above.

Gondaliya CPA offers support around audit defense & risk reduction — helping clients manage tricky tax stuff while staying compliant.

Table 1: Common Toronto T2 Filing Mistakes And How To Avoid Them

| Mistake | Impact | Prevention Tip |

|---|---|---|

| Incorrect Income Reporting | Wrong taxable profit | Check all revenue sources carefully |

| Missing Schedules | Slow processing | Attach all needed forms |

| Misclassified Expenses | Deductions denied | Sort expenses properly |

| Incomplete Deductions | Lost savings | Keep detailed receipts |

Table 2: Checklist For Accurate T2 Preparation And Filing Process

- Keep financial docs organized all year

- Reconcile bank statements every month

- Track grants & investments fully

- File/pay by official deadlines

- Ask CPA experts early if unsure

Follow these tips along with help from Gondaliya CPA to cut down common errors seen in many Toronto businesses today.

Frequently Asked Questions (FAQs)

- What are common T2 filing mistakes?

Typical mistakes include wrong income amounts; missing schedules; mixing personal/business expenses; incomplete deductions; late filings causing fines. - How can I avoid CRA penalties?

File right returns quickly; keep good records; pay installments on time; get expert advice when needed. - What documents are critical for accurate filing?

Receipts/invoices proving expenses; monthly reconciled bank statements; payroll info if any; proof of grants/investment earnings. - Can I file my corporation’s return electronically?

Yes! E-filing speeds up processing and checks accuracy better than paper. - When should quarterly installments be paid?

Usually every three months based on last year’s estimates unless CRA says otherwise. - What happens if I miss a payment deadline?

Interest builds daily until paid plus possible late fees depending on amount overdue. - Are there benefits working alongside a professional accountant?

Definitely – they spot deductions you might miss saving money long-term . - Does disorganized bookkeeping increase audit risk?

Yes – messy records raise red flags making audits more likely . - Is it necessary disclose foreign earned revenues even partially held abroad ?

Yes – Canada taxes worldwide income no matter where money sits . - How do I handle investment-related incomes properly ?

Report dividends/capital gains separately with broker slips/statements . - Can missing schedules delay refund issuance ?

Sure – incomplete forms mean longer waits due to extra checks . - Should startups follow same rules about installment payments ?

Mostly yes unless specific exemptions apply yearly . - What’s best way maintain ongoing document organization ?

Use cloud platforms that update files securely anytime . - Will an inaccurate return always trigger an audit ?

No but repeated errors boost chances especially over time . - Where do I find updated information about changes affecting my corporation’s taxes ?

Official sites like Canada.ca/taxes post latest rules each fiscal period .

Toronto businesses often make costly corporate tax errors. Many T2 corporate tax filing mistakes come from incorrect expense deductions, mixing personal and business expenses, or ignoring GST/HST rules. These mistakes can cause CRA reassessments, interest fees, or audits.

Knowing these common mistakes helps with proper corporate tax preparation in Toronto. Staying compliant stops penalties and helps your business claim all possible deductions and credits.

Incorrect Expense Deductions

Misclassified expenses cause many T2 filing errors. Some businesses claim incomplete or wrong deductions, which draws CRA attention.

- Misclassified Expenses: Mixing personal costs with business ones leads to rejected claims.

- Meals and Entertainment: Only half of meal costs count as deductions unless special rules apply.

- Home Office Deduction: You must only claim the part used just for business.

Keeping good records and following CRA rules on what counts as an expense helps avoid trouble. Organized bookkeeping makes it easier to separate what’s allowed from what’s not.

Common Mistakes: Personal vs. Business Expenses

People often confuse personal spending with business expenses in Toronto.

Some examples:

- Claiming too much for vehicle costs without logs.

- Adding family-related bills as company expenses.

You need detailed records to show how each cost links directly to your business. This cuts risk if the CRA checks your files.

Guidelines for Eligible Deductions

- Check if each deduction meets CRA rules.

- Save receipts, invoices, and contracts as proof.

- Review tax laws every year since rules may change.

Doing this lowers taxable income while staying within Canadian tax laws—something all Toronto companies should keep in mind for corporate tax compliance.

Misclassifying Employees vs. Independent Contractors

Wrong worker labels affect payroll taxes big time:

- Calling employees contractors means unpaid CPP or EI fees.

- The CRA watches worker classification closely under payroll tax compliance laws.

Correct status helps avoid big bills from income misclassification problems many small Toronto businesses face.

Getting help from a CPA is smart. They base status on actual job tasks, not just contract words—a key move to dodge payroll problems with the government.

Sales Tax (GST/HST) Errors

Many corporations mess up GST/HST reporting:

- Forgetting to register slows down remittance duties.

- Late quarterly payments lead to penalties plus interest.

Keeping neat sales tax records with organized bookkeeping makes following the rules easier. This also lowers chances of GST/HST reporting errors common among Ontario companies.

| Common GST/HST Filing Errors | How To Avoid Them |

|---|---|

| Missing Registration | Sign up right away when needed |

| Late Remittances | Set reminders for payment dates |

| Incomplete Records | Use accounting software daily |

Missed Tax Credits and Deductions

Lots of companies miss good chances like claiming SR&ED credits or other small biz perks because they don’t know about them or lack paperwork.

To get the most from claims, you need expert guidance familiar with programs for Canadian firms wanting better returns.

Table: Checklist for Accurate T2 Preparation & Filing Process

| Step | Action Item |

|---|---|

| Document Collection | Collect all financial reports |

| Expense Classification | Keep personal and business costs apart |

| Employee Status Verification | Check who is employee or contractor |

| Sales Tax Compliance | Confirm GST/HST registration & filings |

| Credit/Deduction Optimization | Spot applicable credits/deductions |

Using this checklist boosts accuracy and cuts costly penalties tied to common T2 filing mistakes Toronto firms run into often.

Follow these tips with professional CPA help for smooth corporate tax preparation Toronto trusts—and protect your company’s money every fiscal year end.

Consequences of Corporate Tax Filing Errors in Toronto

Making mistakes on your corporate tax return can cause big problems for businesses in Toronto. The Canada Revenue Agency (CRA) checks T2 returns carefully. They look for errors like wrong income numbers or missing papers. When they find mistakes, CRA often does reassessments. This means they review your tax return again and may ask you to pay more.

You could get a Notice of Reassessment after that. It tells you that you owe extra taxes plus penalties and interest charges. If mistakes happen often or are serious, CRA might start a full audit. Audits take time and cause stress. They can mess up your daily work.

Fixing errors with tax return amendments slows things down too. You’ll spend extra time on paperwork. These problems hit your money and can hurt how the CRA sees your company.

Penalties, Interest Charges, and Potential Audits

Toronto companies face tough penalties if they underreport income or miss deductions on T2 forms. CRA penalties can be as high as 50% of the unpaid taxes if the errors look careless or done on purpose.

Interest charges build up every day on unpaid taxes from the due date until you pay everything. This makes your bill even bigger than just the penalty.

Errors also raise red flags with the CRA. That makes it more likely they will audit you. More audits mean more digging into past returns and documents, which is stressful and costly.

To lower this risk, keep good records and talk to expert tax accountants in Toronto who know the rules well.

Common reasons audits increase:

- Incorrect income reporting

- Missing deductions

- Late or amended filings

- Repeated mistakes

Staying organized helps avoid this extra attention.

Disruption to Business Operations and Reputation

Tax filing errors don’t just cost money; they disrupt your business too. Answering CRA questions or dealing with audits takes time away from work like sales or serving customers.

Mistakes can also hurt your reputation with people who trust your business—like investors or lenders. This damage might make getting money harder later on.

Also, missing deductions means you lose real chances to save on taxes and improve cash flow throughout the year.

Using stress-free filing methods like electronic submission helps reduce mistakes and speeds up processing with the CRA. Working with skilled CPAs adds another layer of safety so you can focus on running your company.

| Common Consequences | Impact Description |

|---|---|

| CRA Reassessments | They change assessments which lead to paying more taxes |

| Penalties & Interest | Money charges that increase what you owe |

| Increased Audit Risk | Higher chance of detailed CRA checks |

| Business Disruptions | Time spent fixing issues instead of working |

| Reputation Damage | Loss of trust from important stakeholders |

Knowing these risks helps Toronto companies plan better for smooth, correct T2 filings — protecting their money and peace of mind every year.

Table: Checklist for Accurate T2 Preparation & Filing Process

| Step | Action Item |

|---|---|

| Review all Income Sources | Make sure all income is reported |

| Organize Supporting Documents | Keep receipts and schedules handy |

| Classify Expenses Correctly | Put expenses in the right categories |

| Claim Eligible Deductions | Check that deductions qualify |

| Use Electronic Filing | Submit returns through certified software |

| Consult a Professional CPA | Have an expert check before sending |

Following this list helps prevent common mistakes that lead to costly reassessments or CRA audits.

For guidance made for Toronto businesses dealing with tough corporate tax rules — including audit help — contact trusted experts at Gondaliya CPA today.

Frequently Asked Questions (Excerpt)

- What are common T2 filing mistakes?

- How can I avoid CRA penalties?

- What documents are critical for accurate filing?

(See full FAQ section below.)

How to Avoid and Fix Corporate Tax Mistakes in Toronto

Corporate tax mistakes can cost you a lot. They lead to big penalties, more audits, and lost chances for tax breaks. To keep your business safe and follow CRA rules, you need to file your taxes right. Start by checking all your documents carefully before sending your T2 return. This helps you find errors like wrong income numbers or missing forms.

Avoiding these mistakes lowers the chance that CRA will reassess your return or charge interest. If you find a mistake after filing, fix it fast by making a voluntary disclosure. This cuts down on penalties. Staying on top of things keeps your finances safe and keeps CRA happy.

Implementing Robust Bookkeeping and Record-Keeping Practices

Good bookkeeping is the backbone of correct corporate tax filing in Toronto. You should keep clear records of all money coming in and out using bookkeeping best practices that fit local rules. Keeping tax documents safe supports everything you report on your T2.

Organize your business financial records well: invoices, receipts, bank statements, payroll papers. Keep them neat all year long. Regular record keeping makes tax time easier and shows proof if CRA asks for it.

Try using reliable accounting software or hire pros who know their stuff. They help make sure no important info slips through when you prepare taxes.

Common Bookkeeping Best Practices

- Update financial data often

- Keep personal and business money separate

- Save all supporting documents

- Check accounts every month

Benefits for Your Business

- Fewer errors on your T2

- Easier expense sorting

- Proof for deductions if needed

- Find mistakes early

Staying Up-to-Date with Tax Law Changes and CRA Guidance

Tax laws change a lot in Canada—both federally and provincially. Staying updated helps you follow corporate tax rules correctly. The CRA sends out guidance that changes how businesses report income or claim deductions on their T2 returns.

You can subscribe to CRA newsletters or check trusted sources about Canadian taxes to stay informed yearly. Knowing about new rules stops accidental mistakes that could cause audits or fines.

Getting ongoing help from smart accountants lets your company adjust fast to new laws without missing credits or other tax benefits.

Seeking Guidance from Experienced Toronto Tax Accountants

Getting help from professional CPAs means you get expert advice to avoid common Toronto corporate tax filing errors. These accountants explain complicated rules clearly while planning smart tax moves for your business.

Working with skilled pros lowers stress around deadlines and boosts accuracy through careful checks before you file. They also back you up if CRA has questions after filing, which cuts risks.

Their advice helps you choose the right deductions, credits, and compliance steps—saving money and cutting penalties from mistakes.

The Role of Gondaliya CPA in Ensuring Accurate Corporate Tax Filing

Gondaliya CPA works as a trusted corporate tax accountant in Toronto businesses count on. They provide professional CPA assistance that fits your company’s needs. Their expert help offers reliable tax support during every stage of corporate tax preparation Toronto firms need.

They make tax rules easier to understand with clear explanations and ongoing support. This lowers the chance of costly mistakes. Gondaliya CPA uses proactive tax management to keep your business on track with deadlines and rules.

This method helps reduce audit risk while making sure your filings are accurate. When you choose their team, you get peace of mind knowing your T2 return is done right.

Expertise in T2 Return Preparation and CRA Compliance

Filing the T2 corporate tax return correctly means checking all documents closely and following Canada Revenue Agency (CRA) rules. Gondaliya CPA knows common T2 corporate tax filing errors well, like missing schedules or wrong income reports.

They have solid knowledge of corporate tax compliance Toronto expects. This helps keep all your filings legal and complete. They also suggest using electronic tax filing benefits.

Electronic filing means faster processing, fewer mistakes, and quick confirmation from the CRA. Working with experts who know CRA rules helps avoid delays from reassessments or penalties caused by errors.

Here’s how they help avoid mistakes:

- Careful review of all paperwork

- Checking for missing forms

- Double-checking income numbers

- Following up on CRA guidelines

Proactive Identification and Resolution of Potential Errors

Tax error consequences can hit hard. You might owe more taxes plus interest if there are reassessments. That’s why filing on time matters along with a full look at your income.

Gondaliya CPA tells clients to keep neat records all year long. This makes it easier to check everything before filing.

They take steps like:

- Making sure deductions are complete

- Confirming expenses go in the right category

- Cross-checking income against sources

These checks lower the risk of mistakes that could cause audits or fines from the CRA.

Audit Support and Risk Mitigation Strategies

Getting audited can feel tough without help. Gondaliya CPA offers audit support to cut down audit risk before it starts. They prepare you well by matching your documents to your filed returns.

Their risk plans include checking records regularly during the year instead of waiting until tax time rushes in. This steady watch keeps filing stress low and can help dodge audits altogether.

If an audit happens, their CPAs explain what to do clearly and quickly so your business stays safe at every step.

| Common Mistakes | How Gondaliya CPA Helps Avoid Them |

|---|---|

| Incorrect Income Reporting | Checks income carefully against records |

| Missing Schedules | Uses a checklist to catch missing forms |

| Misclassified Expenses | Reviews expenses for correct categories |

| Incomplete Deductions | Examines all deductions thoroughly |

By working with corporate tax accountant Toronto companies trust like Gondaliya CPA, businesses get accurate filings plus smart advice on managing taxes ahead of time. This helps keep things running smoothly under Canadian law.

Frequently Asked Questions (FAQs)

What is the importance of timely filing for Toronto corporations?

Timely filing prevents tax penalty interest charges and helps your business stay compliant with CRA deadlines.

How can organized bookkeeping reduce audit risks?

Organized bookkeeping ensures accurate financial statements and thorough document review, lowering audit risk.

What benefits does electronic tax filing offer for T2 returns?

Electronic filing enables faster processing, reduces errors, and speeds up CRA confirmation.

Why should businesses classify expenses properly?

Correct classification between capital vs operating expenses ensures tax deduction eligibility and avoids reassessment risks.

What is the role of tax credit optimization in corporate tax filing?

Optimizing tax credits like SR&ED credits lowers taxable income and maximizes savings legally.

How do quarterly tax installment payments affect corporate tax compliance?

Making installment payments on time avoids interest charges and maintains good standing with CRA.

When is the voluntary disclosure program useful?

It helps correct past mistakes before CRA detects them, reducing penalties and interest charges.

Why should Toronto businesses update themselves on tax code updates?

Tax code updates impact deductions, credits, and compliance. Staying informed avoids costly mistakes.

How can a corporate tax accountant assist in payroll tax compliance?

They verify employee classifications and ensure correct payroll taxes are paid to avoid penalties.

Essential Practices for Toronto Corporation Tax Filing Success

- Keep all business financial records updated throughout the fiscal year.

- Use accounting software for tax to simplify bookkeeping and reporting.

- Separate personal expenses from business expenses clearly.

- Track GST/HST compliance Toronto rules carefully to avoid penalties.

- Maintain proper documentation retention policies for at least six years.

- Review your T2 return checklist before submission to confirm completeness.

- Consult a professional CPA regularly for strategic tax planning advice.

- Prepare for fiscal year-end planning early to avoid last-minute errors.

- Use cloud bookkeeping Toronto solutions to improve accuracy and accessibility.

- Monitor changes in corporate income reporting requirements annually.

- Submit all required forms on time according to corporate tax deadlines Toronto.

- Understand limitations on meals, entertainment, vehicle expenses, and home office deductions.

- File any necessary Form T1135 for foreign income disclosure promptly.

- Address any required tax return amendments quickly to reduce additional charges.

- Implement regular tax compliance training for relevant staff members.

Following these steps will help you avoid costly penalties and lost tax opportunities while ensuring financial protection and smooth CRA audits.

Sharad Gondaliya is a CPA Canada & CPA USA with 14 Years+ experience of Accounting, Tax, Payroll of Corporate Small Businesses as Tax Accountant. He is fully certified CPA Ontario and CPA USA and is well known among corporate small businesses for tax planning, efficient tax solutions, and affordable CPA services. Sharad is the Principal (Director) of Gondaliya CPA – Affordable CPA Firm in Canada. Licenses: CPA Ontario: 61040184 | CPA USA (MT): PAC-CPAP-LIC-033176 | CPA USA (WA): 57629 | CPA Firm License: 61330051 View Full Author Bio